What Is Revenue Churn? (And How to Reduce It)

Revenue churn is a retention metric that measures a company’s revenue loss due to customer cancellations, downgrades, or reductions in spending.

Revenue churn is a retention metric that measures a company’s revenue loss due to customer cancellations, downgrades, or reductions in spending. Popular among SaaS companies with subscription-based business models, it’s a helpful data point that provides insights into the effectiveness of a company’s customer retention efforts and overall financial sustainability.

The churn of any variety can spell trouble for organizations that rely on recurring revenue, but there isn’t a universal benchmark for healthy and unhealthy levels of revenue churn. It depends on the company’s goals, growth plans, and profitability. The root cause of revenue churn is also an important consideration—you can’t improve a metric if you don’t understand what’s driving the numbers.

If you’re responsible for monitoring and moving revenue or retention-related metrics, revenue churn is a data point you’ll likely encounter. Learn how to calculate and analyze it, then use that knowledge to improve your customer-retention strategies and reduce churn.

Key takeaways

- Some degree of revenue churn is inevitable. The key is to replace lost revenue faster than you lose it to churn.

- Revenue churn can stem from a variety of sources, both internal and external. Some culprits, like poor customer service, are controllable. Others, like the number of competitors in your market, are beyond your control.

- When reducing revenue churn, focus on the product experience, customer engagement, and retention by communicating a strong value proposition.

Calculating revenue churn

Revenue churn compares a company’s lost customer revenue to overall revenue earned over a specified period, often a month. It’s calculated as a percentage using the following formula:

Revenue Churn Rate = (Lost Revenue from Churn / Total Revenue at the Start of the Period) × 100%

Consider a SaaS company that sells subscriptions for a marketing automation tool. It has a monthly recurring revenue (MRR) of $87,500 at the start of the month. Throughout the month, churn resulted in a loss of $12,250 in MRR:

Revenue Churn Rate = ($12,250 / $87,500) ×100% = 14%

This company is losing 14% of its total revenue base every month due to cancellations or downgrades.

What is a healthy amount of revenue churn?

Virtually all subscription-based companies experience some level of churn, but what constitutes a “good” amount varies from one company to the next. Let’s say a company consistently acquires new customers faster than it loses customers each month. In this scenario, it’s likely the company is maintaining or even growing its overall revenue.

When determining what percentage of revenue churn is acceptable for your company, the key is to set a goal that balances new customer acquisition with existing customer retention. That way, you’ll have sustained growth regardless of your churn rate.

There are specific timeframes when churn is more likely to occur. New user churn is generally highest during a user’s first month with the product. According to investor Lenny Rachitsky, average new user churn during the first month is anywhere from 5% to 50%.

What are some common causes of revenue churn?

Several factors can significantly impact revenue churn.

Lackluster customer engagement and support

Unhappy, dissatisfied, and unengaged customers are more likely to cancel or downgrade their subscriptions.

Engaging customers and consistently providing them with an excellent experience spans the entire customer journey, from acquisition through retention. When you’re determining if customer-facing issues are driving revenue churn, assess these areas:

- Onboarding and training: Customers won’t get the maximum value from your product if your onboarding and ongoing training are poor. Check your company’s key activation metrics and set up new customer interviews to understand if their needs are being met.

- Customer service: Customers who need help expect quick response times and speedy resolutions to their problems. To determine whether poor support could lead to revenue churn, look at service-related metrics such as first response time, resolution time, customer satisfaction scores (CSAT), and ticket escalation rates.

- Product activation: Activation refers to the first moment a new user has a positive, value-driven experience with a product and when they provide value back to the business. Activated users are more likely to maintain their subscriptions. If your activation rates are low, assess how to help customers find value faster in their first experiences with the product.

Misalignment between cost and value

Customers are cost-sensitive: if they’re going to pay for a product or service, its price and value have to align. To determine whether your pricing model and value propositions contribute to revenue churn, try these tactics:

- Conduct a survey: Ask for customer feedback about pricing and perceived value. Surveys are simple and effective tools that help determine how customers truly feel.

- Complete a competitive analysis: Compare the competition’s pricing strategies and value offerings to your own. You may discover discrepancies that explain why users choose other solutions.

- Review usage analytics: Look at the usage patterns between different subscription tiers and price points and note which are more popular. You’ll see which features and options customers value most, which can help you further make the most of your pricing.

Note that, sometimes, a mismatch between price and perceived value results from a communication problem. If your pricing model seems airtight, look at your marketing materials to see if your product’s value proposition is clear.

External economic conditions

Economic downturns, industry shifts, and other market conditions all dictate customer budgets and priorities. When economic conditions lead to strained budgets for your customers, these strategies can help them get more value from your product:

- Flexible pricing structures, such as short-term contracts, discounted plans, and scaled pricing tiers

- Personalized offerings beyond standard subscription features

- Enhanced support and training to help customers solve common problems and maximize the value of their subscription

- One-on-one consultancy services for top-tier clients

The goal is to deliver extra value that showcases how useful your product (and company) is, enhancing the customer experience while helping them further justify their subscription.

What are the best ways to reduce revenue churn?

In addition to the solutions described above, here are two more strategies to keep in mind the next time you’re thinking about ways to reduce revenue churn.

Focus on customer retention.

Customer retention refers to the frequency at which customers return to your product over time. Ideally, you’ll have a strong base of loyal, long-term customers. If you want to improve customer retention, it’s essential to understand why, when, and how your customers are either retained or churned.

Most resources on customer retention focus on quick hacks, but it’s a topic that’s worth exploring deeper. That’s why we compiled this list of quality resources and proven strategies: The Amplitude Guide to Customer Retention: 40+ Resources to Increase Retention.

Push for product improvements.

Sometimes, revenue churn results from a poor product experience. If you learn that customers are submitting frequent reports about issues with the product, it’s time to advocate for changes.

It’s easier to push for product improvements when you have data to back you up.

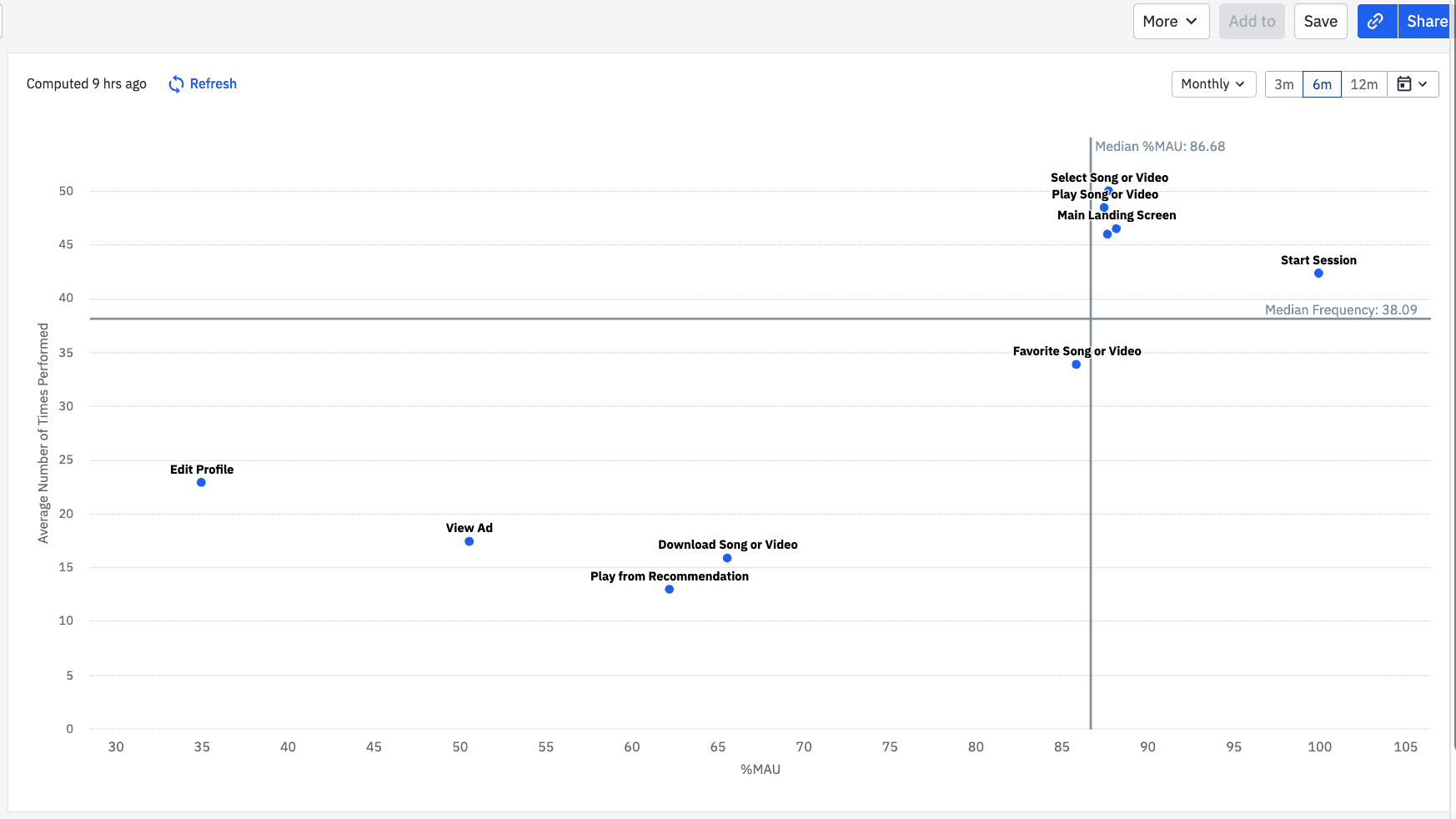

For example, an analytics platform like Amplitude gives you a detailed look at feature usage via an easy-to-interpret Engagement Matrix. At a glance, see which features customers use regularly and which ones receive little attention. Then, dig deeper to see if there’s a reason behind the lack of usage for the unpopular features.

Track revenue churn and other essential product metrics

Calculating and tracking revenue churn will help you understand the financial impact of your customer retention efforts. However, it’s worth noting that it’s most helpful when tracked alongside other product metrics.

The Amplitude Analytics platform tracks your most important metrics and provides deep insights into customer behavior. It simplifies the process of collecting and analyzing product data, giving teams more time to focus on managing, marketing, and improving their products.

Sign up for free today and start making strategic, data-driven decisions that drive growth.

Michele Morales

Senior Product Marketing Manager, Amplitude

Michele Morales is a product marketing manager at Amplitude, focusing on go-to-market solutions for enterprise customers.

More from Michele